The top 3 questions … and answers … about Social Security

Social Security is part of almost every American’s retirement income. Yet if you’re like most people, you probably have a few questions.

How much Social Security will you receive?

In 2015, the average Social Security retirement benefit was $1,328 per month for someone who has reached full retirement age.

The maximum benefit for someone retiring in 2016 at full retirement age is $2,639. But if you’re expecting to hit the Social Security jackpot, keep in mind you’d need to earn the maximum taxable earnings for at least 35 years. In 2015, the earnings ceiling was $118,500.

When can you start collecting?

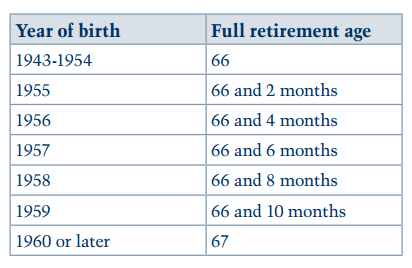

While you can start collecting the retirement benefit when you turn 62, full retirement age likely won’t occur until you’re 66 or older:

What about retiring early?

If you do decide to retire early, the government reduces your benefits by about one-half of 1% for each month you start your Social Security before your full retirement age. If your full retirement age is 66, and you decide to retire when you’re 62, you will only get 75% of your full benefit.

Just as there’s a financial penalty to retiring early, there’s a benefit in delaying retirement.

The government increases your benefit by a certain percentage, depending on when you were born. They add the increase automatically to your benefit each month from the time you reach full retirement age, until you start taking benefits or reach age 70, whichever comes first.

Still have questions?

Fortunately, there are online resources to help:

Social Security: Understanding the Benefits

Social Security’s Online Tools

AARP’s Social Security Calculator

Review your personal Social Security statement

Deciding between early and late retirement

For early retirees, should you continue to earn money when you collect benefits

[maxbutton id=”4″]