Financial Planning for

Business Owners

Business owners have to be versatile in how they operate, and so do their financial plans. At Vertical Wealth Management we meet these complex needs efficiently. In-house tax and accounting, financial planning, and property expertise are found all in one place.

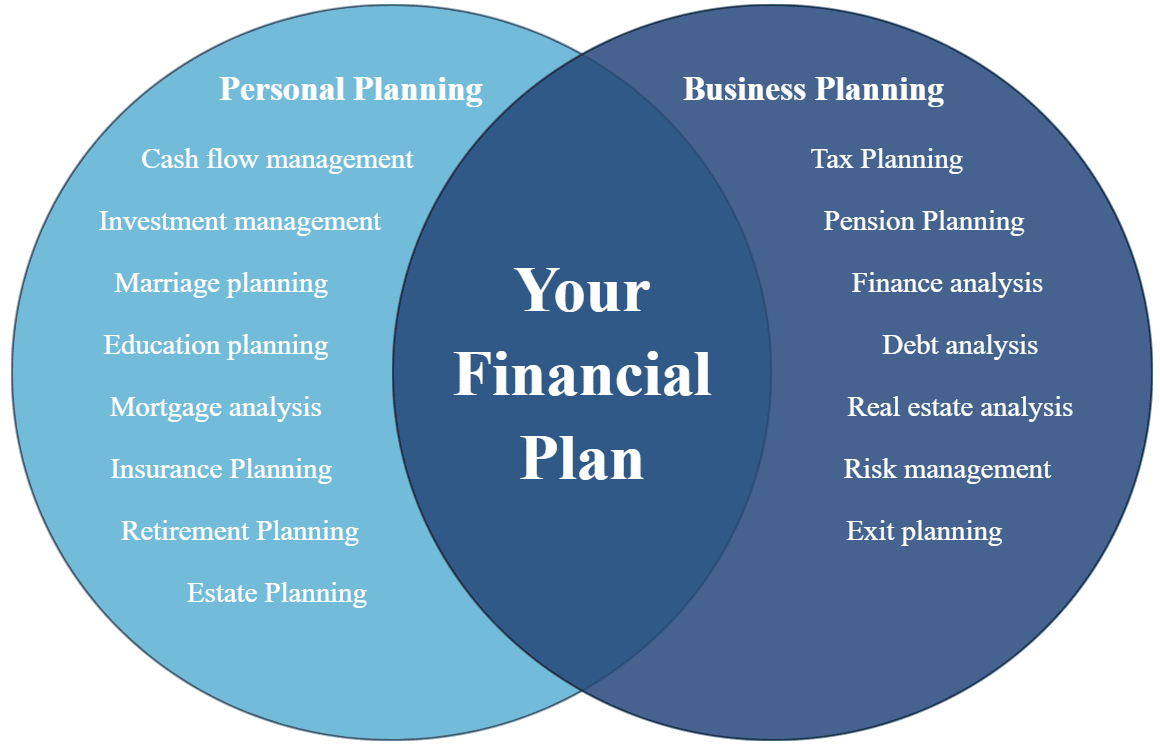

Additionally, we understand the difficultly in managing both business finances and personal ones. But by partnering together, we integrate both seamlessly to bring you the best of both worlds.

Integrated Planning for Small Business Owners

Business Planning Involves:

-

- Tax Planning

- Risk Management

- Maximizing Retirement Benefits

- Succession And Exit Planning

Personal Planning Involves:

-

- Defined Benefit Pension Plans

- 401(k) Defined Contribution Plans

- Combined Benefit/401(k) Plans

- Profit-Sharing Plans

- SEP IRA Retirement Plans

- Cash Balance Pension Plan