Quick tips for boosting your retirement plan contributions

Do you worry about the amount of money you’ve saved for retirement?

If yes, you’re not too different from most of my clients when they first hired me to help with their financial planning.

Many of them were juggling competing priorities. They wondered how they would simultaneously pay off their debts, save for the kids’ education and put enough money away for retirement.

Some of them want to retire early. Others intend to continue working part-time once they retire. Most have heirs and charitable causes they care deeply about. A few have health concerns. A handful worry they’ll need to care for aging parents.

There’s certainly no one-size fits all approach to retirement saving. But there are some simple steps almost everyone can take to boost retirement plan contributions.

#1 Start Early

If you save too little, or start saving too late, you risk reaching retirement age without enough savings.

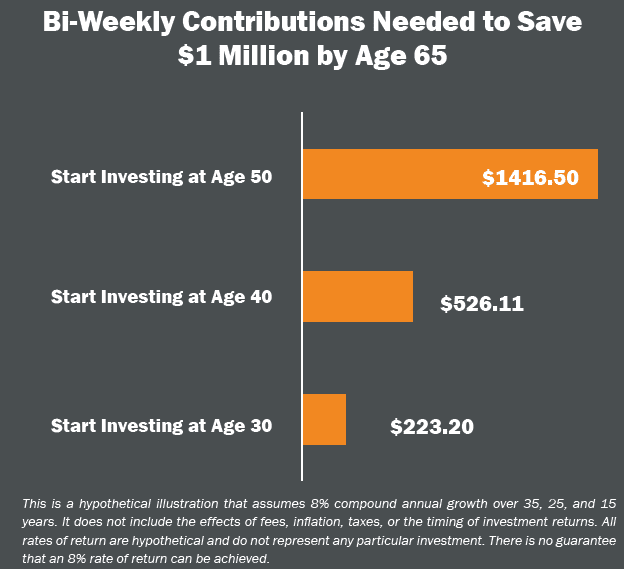

This chart shows the hypothetical bi-weekly savings needed to build a $1 million nest egg by age 65:

There’s a big difference in your contributions when you start investing at age 50 versus age 30.

#2 Take advantage of matching contributions

If it’s too late for you to start investing early, you can still catch up.

Many employers provide matching contributions to your account, usually between 50% and 100% of your contributions up to a certain limit. By taking advantage of your employer’s extra contributions, you can dramatically increase your savings over time.

A good rule of thumb is to contribute as a minimum at least enough to get your full employer match. For example, if your employer matches up to 5% of your salary, you’d be giving up free money by contributing any less.

#3 Increase your contribution rate

When you enrolled in your company’s retirement plan, you might have opted for the default contribution amount, which is often too low a savings rate to give you a comfortable nest egg.

One of the savviest moves you can make as an investor is to increase your contribution rate to your retirement plan as much as you can.

If you haven’t reviewed your contributions recently, a financial representative can help you understand how much you are allowed to contribute and how to boost your savings rate while still living a comfortable lifestyle now.

It can be hard to increase your contribution rate suddenly, which is why I recommend taking a gradual approach and increasing your deferrals each year. I typically suggest you save a minimum of 10% of your salary, and gradually increase contributions to 15% or 20% as you approach retirement.

#4 Defer taxes when you can

Time and tax deferred growth can be 2 critical ingredients to long-term financial success.

Taxes can take a big bite out of investment returns, which is why it makes sense to use the tax advantages of your qualified retirement accounts to save money for the future. The benefits of compound growth and tax deferral mean that small, consistent contributions have the potential to grow significantly over time.

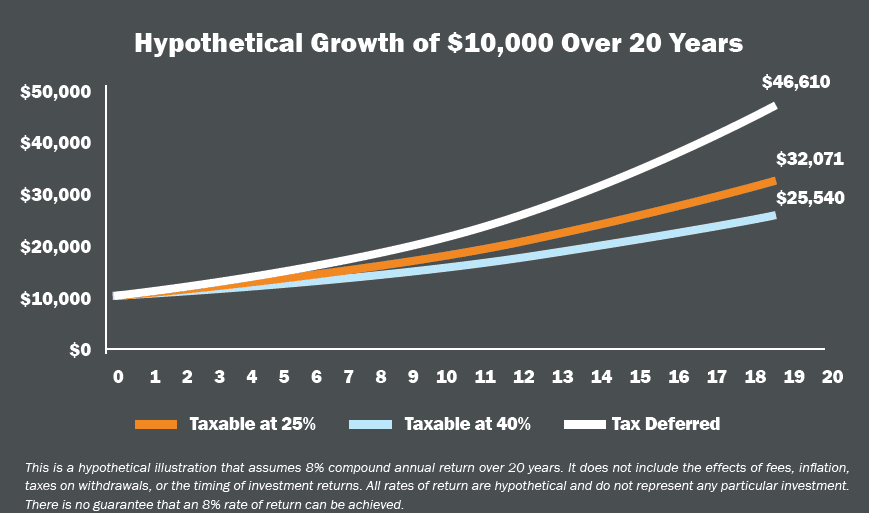

Here’s the hypothetical growth of $10,000 growing at 8% annually in 3 possible tax scenarios:

Money you invest in taxable accounts grows significantly less each year because of the effects of taxes on your returns. Depending on your tax bracket, the difference can be significant.

Eventually, you will have to pay taxes on withdrawals from your retirement plan.

The good news is many Americans find themselves in a lower tax bracket during retirement and pay less in taxes. If you believe you are currently in a lower tax bracket now than you will be in retirement, you may want to speak to a financial representative about contributing to a Roth IRA or another after-tax retirement savings account.

#5 Catch-up contributions

As you approach retirement, the IRS allows you to contribute more to your retirement plan. These “catch-up” contributions are a great way to boost your savings at the point in your career in which you’re likely making the most money.

One step at a time

Regardless of your financial situation, it’s not too late to start saving for retirement. Just take things one step at a time. Take advantage of your employer’s matching contributions, increase your contribution rate, defer taxes if possible, and make catch-up contributions whenever you can.

You’ll increase your retirement contributions and, most importantly, enjoy the peace of mind that comes with proper financial planning.

What you can do now:

- Increase your salary deferral every time you get a raise.

- Create a budget and minimize unnecessary expenses to leave extra room for savings.

- Clarify your plan fees and maintenance charges to be sure that you’re not paying too much.

- Keep your savings invested when you switch employers—even if it means wrestling with complex paperwork.

- Develop a long-term financial strategy by mapping out important milestones, such as a house purchase, a child’s college expenses, or your future retirement.

[maxbutton id=”4″]